carried interest tax proposal

The law known as the. Apart from the negative impact of tax.

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Present law The Tax Cuts and Jobs Act added Section 1061 to the Internal Revenue Code effective for taxable years beginning after December 31 2017.

. Biden also proposed raising the capital gains tax rate for households earning over 1 million a year to 396 which is the proposed top income tax rate. If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed interest rate for the tax. House Democrats Float 265 Top Corporate Rate in Tax Blueprint.

9945See news coverage of the final regulations here. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free. Transfers of carried interest would be subject to tax at short-term capital gain rates even if a non-recognition provision would otherwise apply.

In the first months of his presidency Biden proposed a sweeping list of tax increases that would kick in for individuals earning at least 400000 a. The matter has been adjourned for now. Susan Minasian Grais CPA JD LLM.

Several lawmakers have also introduced the Carried Interest Fairness Act which would tax carried interest at ordinary income tax rates and treat it as wages subject to employment taxes. Venture investors shrug at proposed changes to US carried interest taxation. The Congressional Budget Office has estimated that taxing carried interest as ordinary income would raise 14 billion over a decade.

The proposed change in law would be effective. The IRS finalized these regulations in January 2021 with a few changes TD. The tax proposal wouldnt eliminate carried interests as impliedit would only extend the holding period from three to five years for a.

Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they contributed any initial. While the committee stopped short of taxing all carried interest as ordinary income the restrictions included in the bill pose a direct threat to philanthropic givers and the charitable sector as a whole. Unlike previous proposals in other states even funds located outside the state would be hit by the tax if they invest in Maryland businesses.

Under existing law that money is taxed at a capital gains rate of 20 percent for top earners. T he Democrats latest plan to hike taxes on carried interest a form of income earned by private equity funds that is subject to a lower tax. A compromise in Congress is forming among Democrats to tinker with the tax code generate revenue by other means and.

The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration. Carried interest is very generally a share of the profits in a partnership paid to its manager. At most private equity firms and hedge funds the share of profits paid to managers is about 20 percent.

The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation. 2 days agoDemocrats proposed tax hikes probably wont affect you in fact theyll help you buy an electric vehicle and put solar panels on your.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried interests REG-107213-18Editors note.

The lawmakers provided this example. The carried-interest tax hike is part of the Democrats broad proposals to increase taxes on corporations and wealthy individuals to finance new spending on.

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

A New Era For Carried Interest In Hong Kong Kpmg China

How To Tax Capital Without Hurting Investment The Economist

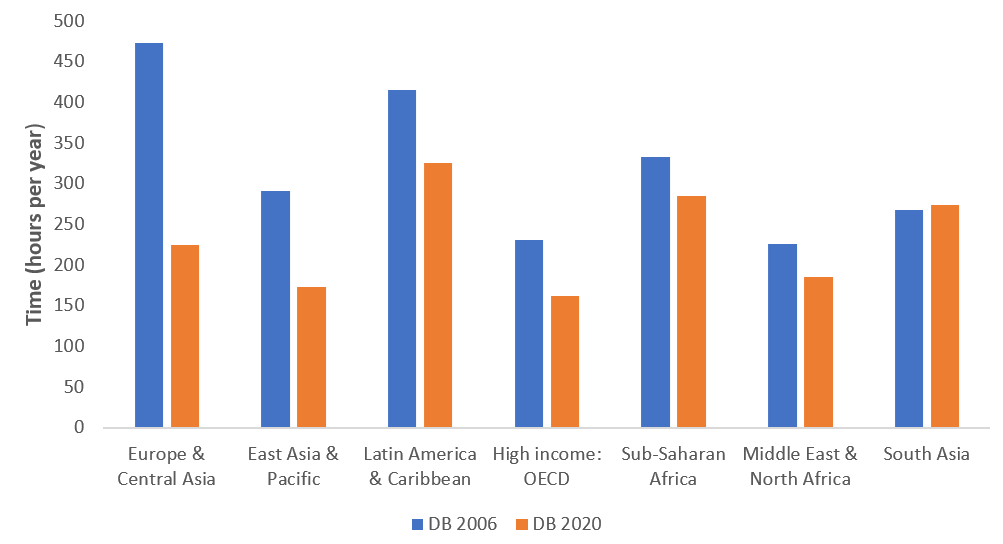

Paying Taxes Reforms Doing Business World Bank Group

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

What Is The Tax Expenditure Budget Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Proposed Improvements To The Beckham Law In Spain Simmons Simmons

House Ways And Means Committee Tax Proposal

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

How Should Progressivity Be Measured Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Pwc Cn Publication New Year Good News Carried Interest Tax Concession