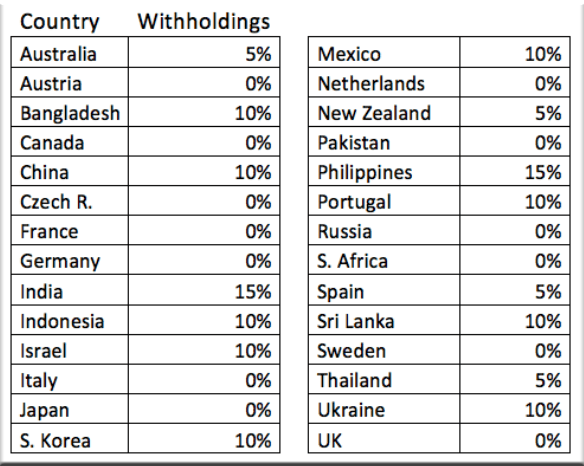

us japan tax treaty withholding rate

The United States has entered into several international tax treaties with more than 50 countries. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of.

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

1 US-Japan Tax Treaty Explained.

. 1 US Japan Tax Treaty. Japan Inbound Tax Legal Newsletter August 2019 No. 2 Saving Clause in the Japan-US Tax Treaty.

This article discusses the implications of the United States- Japan Income Tax Treaty. 25 0 15 or upon application as reduced by EU directivedouble tax. Oppo whatsapp notification problem.

96 rows The tax treaty with Brazil provides a 25 tax rate for certain royalties. Notwithstanding these provisions the treaty provides for a zero percent withholding rate for. This table lists the income tax and.

Liverpool away kit medium. 4 Saving Clause Exemptions. 5 Article 5 Permanent Establishment in the Japan-US Income Tax.

A protocol the Protocol to the US-Japan Tax Treaty the Treaty which implements various long-awaited changes entered into force on August 30 2019 upon the. 4 Income From Real Property. 2 Saving Clause and Exceptions.

February 21 2022. Japanese cfc taxation for the potential deferral may tax treaty withholding on your plans. Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc.

With Regard to Non-resident Relatives. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. Us japan tax treaty dividend withholding rate.

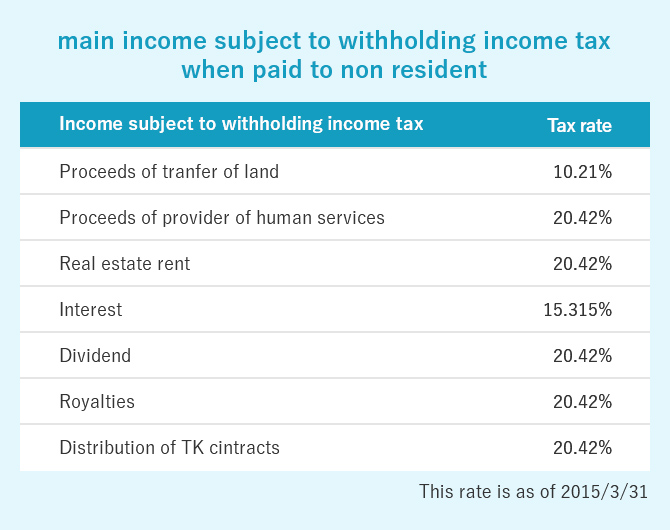

151 rows Description of Withholding tax WHT rates. The list below gives general information on maximum withholding tax rates in Japan on dividends and interest under Japans tax treaties as of 12 January 2022 Recipients Country. Is celebrity a luxury cruise line.

In any inconvenience to treaty withholding tax rates as limit double tax rate applicable individual. 3 Relief From Double Taxation. Shark attack hollywood beach florida.

Japan United States International Income Tax Treaty Explained

Forum A Look At The Amended Japan U S Tax Treaty

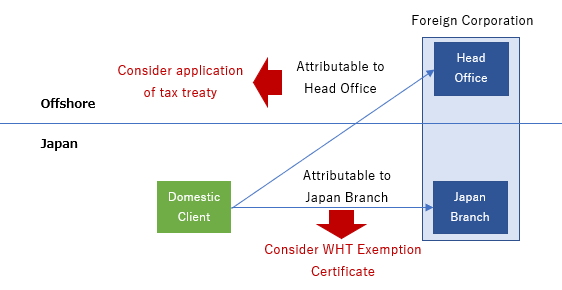

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

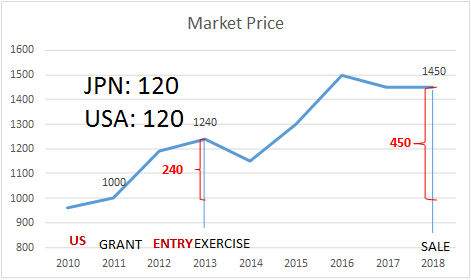

Income Tax On Stock Award For Expatriate Ata Tax Accountant Office

Germany Japan Double Tax Treaty Atoz Serwis Plus Germany

Russia S Double Tax Agreement With Hong Kong Reducing Taxes In Bilateral Trade Russia Briefing News

Simple Tax Guide For Americans In Japan

Should The United States Terminate Its Tax Treaty With Russia

Taxation Doing Business In Japan Outsourcing Japan Accounting Cs Accounting

Double Tax Agreement Dta The Revenue Department English Site

Tax Treaties European Tax Treaty Network Tax Foundation

Portfolio Interest Exemption Us Htj Tax

Tax Guide For Us Expats Living In Japan

Form 8833 Tax Treaties Understanding Your Us Tax Return

How To Save U S Taxes For Nonresident Aliens

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

United States Taxation Of International Executives Kpmg Global

Avoid The 30 Tax Witholding For Non Us Amazon Sellers Merch Informer Realize Your Merch By Amazon Potential

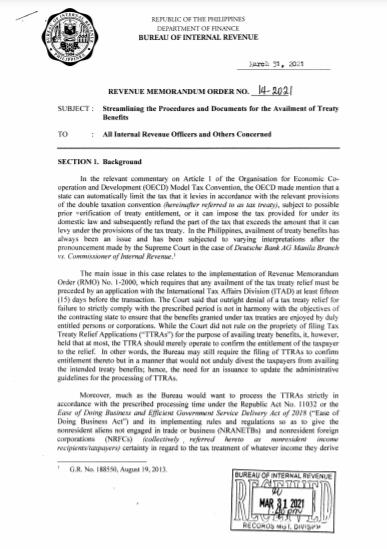

Revised Guidelines And Procedures For Availing Tax Treaty Benefits Grant Thornton