owner draw quickbooks s-corp

You may find it on the left side of the page. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Solved S Corp Officer Compensation How To Enter Owner Equity And Balance The Books Properly After Member Draws Are Taken

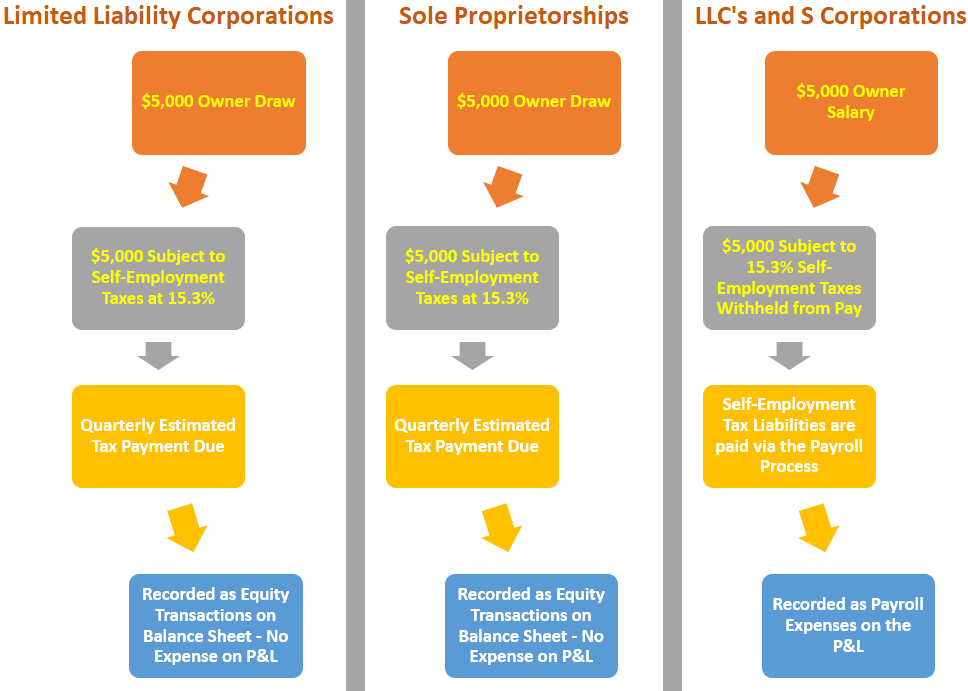

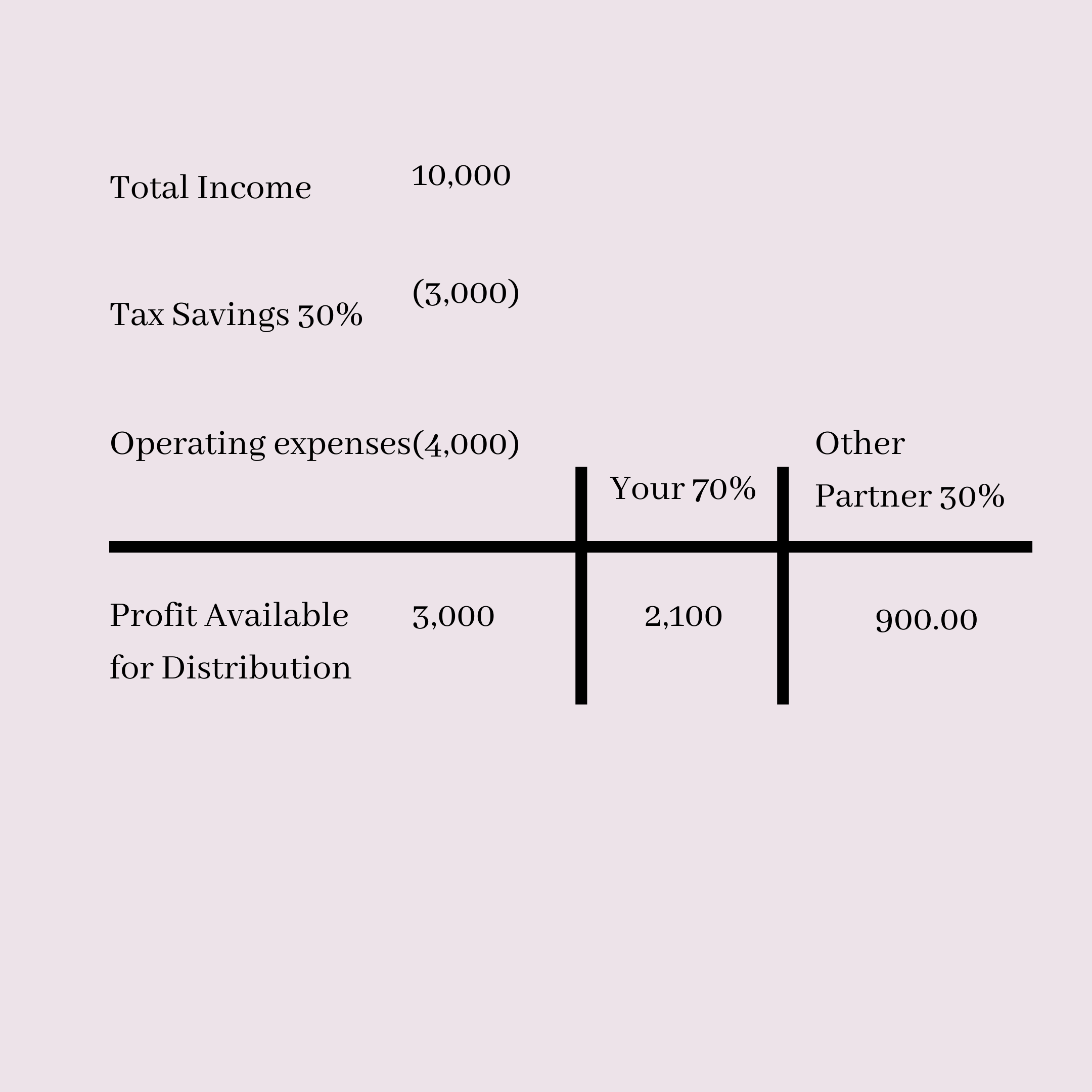

Business owners might use a draw for compensation versus paying themselves a salary.

. Setting Up an Owners Draw Before you can record an owners draw youll first need to set one. Owner Draw Quickbooks S-Corp. Whether we say quickbooks owners draw.

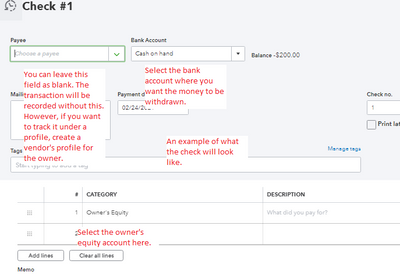

If an owner takes a draw from the business account it increases the businesss liabilities and decreases the owners equity. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner. Apply now for Quickbooks jobs in Buffalo NYNow filling talent for Quickbooks tutorial for new businesses owner Quickbooks Bookkeeper for multiple LLCs for Real Estate Investing and.

Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. Owners draws can be scheduled at regular intervals or taken only when needed. This occurs if the S corp acquired a previous C corp that had earnings and profits or the S corp was a previous C corp and converted to S corp and also had EP.

Below is a list of upcoming QuickBooks Instructor Led Class Dates. Here are some steps Navigate to Accounting Menu to get to the chart of accounts page. These products are used worldwide for AVLGPS Mobile Data Mining Taxis Aircraft tracking Telemetry Robotics Public Safety applications and SCADA.

Follow these steps to set up and pay the. Since an s corp is structured. An owners draw account is an equity account used by QuickBooks Online to track withdrawals of the companys assets to pay an owner.

Paying Yourself in an S Corp The IRS requires that all S corp. Owner Draw Quickbooks S-Corp. The business owner takes.

Business owners might use a draw for compensation versus paying themselves a salary. At the upper side of the page you need to. But I cant find.

All About The Owners Draw And Distributions Let S Ledger

How To Record Owner S Equity Draws In Quickbooks Online Youtube

Managing S Corp Entities To Maximize Tax Benefits Lutz Accounting

How To Complete An Owner S Draw In Quickbooks Online Qbo Tutorial Youtube

I Own An S Corp How Do I Get Paid Clearpath Advisors

Quickbooks Online Plus 2017 Tutorial Recording An Owner S Draw Intuit Training Youtube

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

How To Record Owner Investment In Quickbooks

Solved S Corp Officer Compensation How To Enter Owner Equity And Balance The Books Properly After Member Draws Are Taken

Learn How To Record Owner Investment In Quickbooks Easily

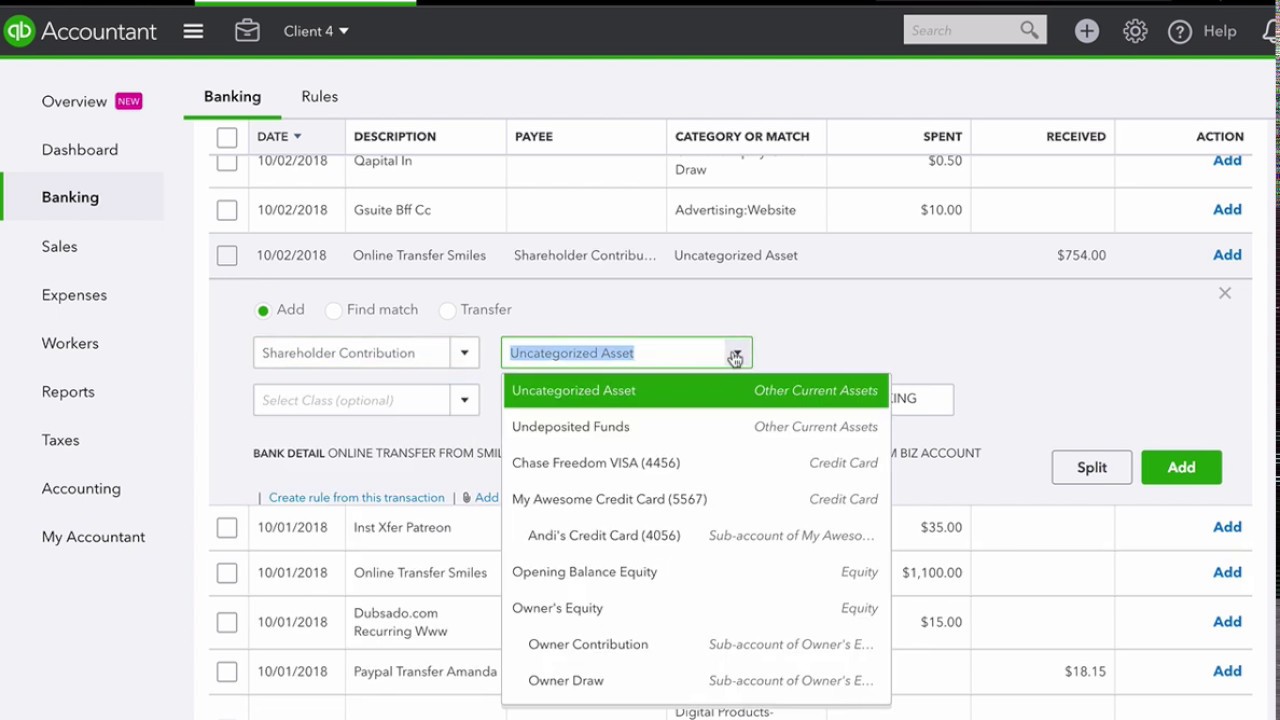

How To Clean Up Personal Expenses In Quickbooks Online

Solved Sole Prop To S Corp Question

How To Categorize Shareholder Distributions And Contributions In Qbo Youtube

Solved Enhanced Payroll Sole Proprietor Converted To Llc

What Is An Owner S Draw Differences By Business Type

Owner S Draw Vs Salary How To Pay Yourself As A Business Owner Freshbooks

Categorizing Transactions In Quickbooks Other Bookkeeping Software Network Antics

Your Complete Guide To Quickbooks For Realtors And Brokers Kyle Handy

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network